Department of Operations Research and Mathematical Economics

The Department of Operations Research and Mathematical Economics was established at the Institute of Informatics and Quantitative Economics on 1st of October 2020 through the merger of the Department of Operations Research and the Department of Mathematical Economics.

History of the Department

-

Department of Operations Research

Operations research is dedicated to the search and creation of mathematical methods used in modeling decision-making processes. The results obtained in the field of operations research are applied in the formulation of decision-making procedures.

In a broad sense, operations research falls under the field of decision sciences. Hence, the applications of operations research within the realm of economic sciences are part of the discipline of management sciences.

The Department of Operational Research focuses on refining formal methods in operations research and their applications in finance and management.In 1991 prof. dr hab. Edmund Ignasiak established the Department of Operations Research at the Faculty of Management of the Poznań Academy of Economics. The department originally brought together employees from the Department of Operations Research and some from the Department of Mathematics. Both of these mentioned departments previously operated within the structure of the Institute of Economic Cybernetics. In 2006 the Department of Operations Research was transferred to the Faculty of Informatics and Electronic Economy, and in 2019 it became part of the Institute of Informatics and Quantitative Economics.

-

Department of Mathematical Economics

The main research directions of the Department are: equilibrium and economic growth theory, turnpike theory, applications of optimal control theory in economics, modelling of cash and physical flows in the economy, macroeconomic models of the balance of payments and the exchange rates, economic convergence, technological progress in the economic growth theory, the new theory of growth, modelling of a research and development activity, human capital and knowledge as endogenous growth factors, object-oriented programming.

The Department of Mathematical Economics stems from the Econometrics Section established in 1965 at the Faculty of General Economics at the former Economic College in Poznań (Wyższa Szkoła Ekonomiczna). A Head of the Econometrics Section for 26 years (until 1991) was professor Zbigniew Czerwiński (1927-2010), one of the most distinguished polish scientists representing quantitative trends in economics comprising of: econometrics, mathematical economics, decision theory and economic cybernetics. The Econometrics Section The Department of Econometrics functioned as part of the Institute of Econometrics and Statistics (1969-1976) in the Faculty of Production Economics, and then as part of the Institute of Economic Cybernetics (1976- 1991) in the Fqaculty of Planning and Management.

In 1991 the Econometrics Section was divided into three Dapertments: of Econometrics, of Operations Research and of Mathematical Economics, which belonged to the Faculty of Economics of the Poznań Economic Academy (Akademia Ekonomiczna w Poznaniu). Since 2006 the Department of Mathematical Economics, along with other quantitative departments (of Econometrics, of Operations Research, of Applied Mathematics, os Statistics) and informatics departments (of Economic Informatics, of Information Technologies), functioned in the newly established Faculty of Informatics and Electronic Economy (Wudział Informatyki i Gospodarki Elektronicznej, WIGE), and from 2019, as part of the Institute of Informatics and Quantitative Economics, which replaced WIGE.

For 24 years (1991-2015) the Department of Mathematical Economics was led by prof. Emil Panek – rector of the University in 1996-2002, co-founder of WIGE and its first dean in 2006/2007-2015/2016. In 2015-2020 the Department was led by prof. dr hab. Piotr. Maćkowiak.article (in Polish) about Professor Zbigniew Czerwiński in Wikipedia

News

-

Publication in the prestigious Journal of Institutional Economics

The article by Osińska M., Malaga K., and Lach B., titled "Investigating relationships between economic freedom, growth, and development in CEE countries," has been published by Cambridge University Press & Assessment in the Journal of Institutional Economics.

Read more -

Publication in the prestigious journal International Review of Financial Analysis (Impact Factor 7.5)

The article by Dr. hab. Agata Kliber, Prof. UEP from the Department of Applied Mathematics, and Dr. hab. Krzysztof Echaust, Prof. UEP from the Department of Operations Research and Mathematical Economics has been published in the International Review of Financial...

Read more

-

Article by dr Izabela Śliwa in Physical Reivew E

Article by: Śliwa Izabela, Maslennikov Pavel V., Shcherbinin Dmitrii P., Zakharov Alex V., titled...

Read more -

Article by dr Izabela Śliwa in Physical Reivew E

Article by: Śliwa Izabela, Maslennikov Pavel V., Zakharov Alex V., titled “Anchoring transitions in t...

Read more -

Article by dr Izabela Śliwa in Physical Reivew E

Article by: Śliwa Izabela, Maslennikov Pavel V., Zakharov Alex V., titled “Paired correlations of di...

Read more

About the Department

-

Research problems of the department

- graph coloring, optimization on graphs and networks

- equitable distribution, stable associations

- decision-making under uncertainty

- scenario planning

- theory of economic growth and development

- financial econometrics

- quantitative finance

- corporate finance

-

Our journal publications in prestigious JCR-listed journals

Central European Journal of Operations Research, Annals of Operations Research, Theoretical Computer Science,

Journal of Mathematical Economics, Computational and Applied Mathematics, Discrete Mathematics,

Economics Letters, Acta Oeconomica, Emerging Markets Review,

Finance Research Letters, Research in International Business and Finance, Journal of International Financial Markets, Institutions & Money,

Physical Review E, Physica A: Statistical Mechanics and its Applications, Journal of Molecular Liquids

-

Cooperation with foreign countries

University of Primorska (Koper, Slovenia), InnoRenew CoE (Koper, Slovenia), University of Maribor (Maribor, Slovenia), University of Szeged (Szeged, Hungary), Paris 1 Panthéon-Sorbonne, Paris 2 Panthéon-Assas, Université de Lorraine (France), Université de Strasbourg, Université de Caen, Université de Rennes 1 (France), Université de Toulouse, Université de Nantes (France), UCL Louvain-la-Neuve (Belgium), Université de Liège (Belgium), ESFAM AUF (Sofia, Bulgaria)

University of Mazandaran (Babolsar, Iran), USJ de Beyrouth (Lebanon), Institute of Problems of Mechanical Engineering (St. Petersburg), School of Entrepreneurship and Business Administration (Kyrgyzstan), American University of Central Asia,

Brown University (USA), Université de Guyanne – Cayenne (French Guiana), UBO Santiago de Chile

Scientific activities

-

Scientific Articles 2025

-

Scientific Articles 2024

-

Scientific Articles 2023

-

Scientific Articles 2017-2022

-

Book publications

-

Academic year 2024/2025

Marcin Anholcer Bieżące działania naukowe – kilka słów o kolorowaniu grafów, szeregowaniu zadań oraz sprawiedliwych i stabilnych przydziałach 13.12.2024 Karolina Sobczak-Marcinkowska Unlocking the Gridlock: Unveiling the Hurdles to European Financial Transaction Tax Cooperation 15.11.2024 Sprawy organizacyjne KBOEM 18.10.2024 -

Academic year 2023/2024

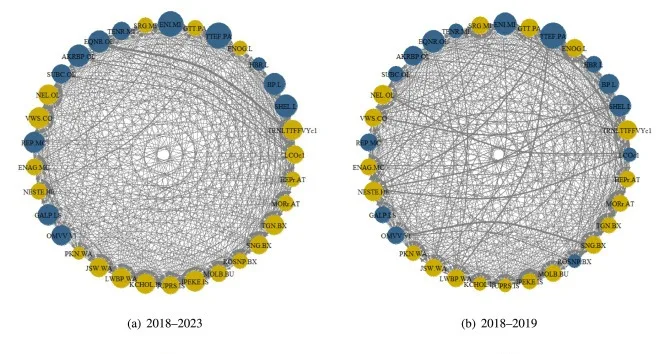

Aleksandra Wójcicka-Wójtowicz On portfolio analysis using oriented fuzzy numbers for the trade-related sector of the Warsaw Stock Exchange 10.05.2024 Justyna Rój The eHealth usage during COVID-19 pandemic 2020 year – Case of Poland 22.03.2024 Paweł Kropiński Community detection in WIG20 with potential application for portfolio selection 2.02.2024 Maciej Bartkowiak Local Fairness in Allocation of Indivisible Goods 2.02.2024 Krzysztof Echaust Reduce losses and save profits with gold and cryptocurrencies: Global stock markets’ perspective 6.10.2023 -

Academic year 2022/2023

Paweł Kropiński State-ownership, probability of informed trading, and profitability potential: evidence from The Warsaw Stock Exchange26.05.2023 Michał Konopczyński Education versus infrastructure: is there a trade-off in an open economy with perfect capital mobility?26.05.2023 Elima Karalaeva American University of Central Asia The scope of scientific activity of American University of Central Asia26.05.2023 Helena Gaspars-Wieloch Possible new applications of the interactive programming based on aspiration levels – case of pure and mixed strategies19.05.2023 Izabela Śliwa Influence of surfaces on the structural properties of liquid crystals28.04.2023 Aleksandra Wójcicka-Wójtowicz Efficiency of stock portfolio long-term recommendations – fuzzy approach28.04.2023 Agnieszka Lach Modyfikacje testów zgodności w analizie rozkładów stóp zwrotu z akcji14.04.2023 Karolina Sobczak Związki nominalnej i realnej sfery gospodarki. Wyniki na podstawie modelu DSGE14.04.2023 Krzysztof Echaust Hedge or not to hedge? Cryptocurrencies, oil and gold against stock markets risk24.03.2023 Marcin Anholcer Uogólnione kolorowania większościowe grafów i digrafów24.03.2023 Paweł Kropiński Algorithmic trading with book order data: evidence from Warsaw Stock Exchange30.01.2023 Krzysztof Malaga The impact of institutional changes on economic freedom in 11 post-socialist countries of Central-Eastern and South-Eastern Europe in 1996-2022Bartłomiej Lach, Krzysztof Malaga4.11.2022 -

Academic year 2021/2022

Paweł Kropiński Does economic policy uncertainty affect central and eastern european markets? Evidence from Twitter-based uncertainty8.07.2022 Justyna Rój Socioeconomic Determinants of Health and Their Unequal Distribution in Poland8.04.2022 Agnieszka Lach Modyfikacje testów zgodności w analizie rozkładów stóp zwrotu z akcji1.04.2022 Paweł Kropiński How Google Trends can improve market predictions – the case of The Warsaw Stock Exchange21.01.2022 Zuzanna Żak Predykcja cen akcji polskich przedsiębiorstw przy użyciu wydźwięku komunikatów w języku polskim14.01.2022 Marcin Anholcer O pewnym problemie Steinhausa17.12.2021 Roman Kiedrowski Modele konkurencji klasycznej w gospodarce wielosektorowej z majątkiem trwałym29.10.2021 8.10.2021 -

Academic year 2020/2021

Ewa Pośpiech

Uniwersytet Ekonomiczny

w KatowicachMetody TOPSIS we wspomaganiu konstrukcji portfela akcji11.06.2021 Paweł Kropiński Optimizing investment strategies with machine learning methods supported by graph-theoretic techniques4.06.2021 Karolina Sobczak Financial Transaction Tax, macroeconomic effects and tax competition issues: a 2-country financial DSGE model14.05.2021 András London Special coloring of graphs: theory, algorithms and applications7.05.2021 Helena

Gaspars-WielochA new application of the goal programming – the Target Decision Rule for Uncertain Problems26.03.2021 Marcin Anholcer Hipoteza o kolorowaniu listowym, grafy jądrowo doskonałe i przydziały stabilne12.03.2021 Krzysztof Malaga Transition and socio-economic changes in Bulgaria and Poland after 1989;Socio-economic transformations in the countries of Central and South-Eastern Europe and the Baltic States in the years 1989-20209.02.2021 Damian Sołtysiak Stabilność monetarnych modeli wzrostu gospodarczego typu Keynesa-Metzlera-Goodwina8.01.2021 Jerzy Marcinkowski Invisible risks vs. investment strategies20.11.2020 Michał Konopczyński The Impact of Budget Deficit, Public Debt and Education Expenditures on Economic Growth in Poland23.10.2020 Krzysztof Echaust Asymmetric tail dependence between stock market returns and implied volatility16.10.2020 Sprawy organizacyjne KBOEM2.10.2020

-

RIELF

The French-language journal Revue Internationale des Économistes de Langue Française has been published since 2016 by the Association Internationale des Économistes de Langue Française (France), the Poznań University of Economics and Business (Poland), and, since 2018, also by Universidade Bernardo O’Higgins in Santiago (Chile).

Its establishment was preceded by the publication of two issues of STUDIA OECONOMICA POSNANIENSIA: issue 12/2014 (10 articles, 16 authors from Belgium, France, and Poland) and issue 2/2016 (9 articles, 18 authors from France, Spain, and Poland), edited by Professor Krzysztof Malaga and Professor Jean-Christophe Poutineau. This Polish-language journal, published by the Poznań University of Economics and Business, served as the prototype (mother journal) for RIELF, which is published in French under the editorship of Professor Bernard Landais and Professor Krzysztof Malaga. Since 2019, RIELF’s Editor-in-Chief has been Professor Krzysztof Malaga.

In total, the two issues of SOEP contained 19 articles authored by 34 scholars from four countries (Belgium, France, Spain, and Poland).

The following issues of RIELF have been published to date:

Vol. 1, No. 1/2016 – 16 articles, 21 authors from Algeria, Belgium, France, Gabon, Cameroon, Morocco, and Poland.

Vol. 2, No. 1/2017 – 15 articles, 21 authors from France, Gabon, Cameroon, Portugal, and Morocco.

Vol. 2, No. 2/2017 – 13 articles, 17 authors from Belgium, Chile, France, Cameroon, Poland, Romania, and Ukraine.

Vol. 3, No. 1/2018 – 13 articles, 17 authors from France, Gabon, Niger, Poland, Senegal, and Togo.

Vol. 3, No. 2/2018 – 17 articles, 24 authors from the Democratic Republic of the Congo, France, Cameroon, Canada, Lebanon, Niger, Portugal, Russia, Tunisia, and Senegal.

Vol. 4, No. 1/2019 – 18 articles, 20 authors from Belgium, Bulgaria, France, Spain, Cameroon, Canada, Poland, Senegal, Togo, and Italy.

Vol. 4, No. 2/2019 – 9 articles, 14 authors from France, Cameroon, Niger, Poland, Senegal, and Togo. This was the first issue published during Professor Krzysztof Malaga’s tenure as Scientific Director of AIELF and Editor-in-Chief of RIELF.

Vol. 5, No. 1/2020 – 11 articles, 23 authors from Spain, France, and the United Kingdom.

Vol. 5, No. 2/2020 – 11 articles, 18 authors from Benin, the Democratic Republic of the Congo, France, Lebanon, Morocco, Poland, Senegal, and Togo.

Vol. 6, No. 1/2021 – 11 articles, 17 authors from Burkina Faso, the Democratic Republic of the Congo, France, Congo-Brazzaville, Mali, Poland, Senegal, and Togo.

Vol. 6, No. 2/2021 – 12 articles, 26 authors from the Democratic Republic of the Congo, France, Mali, Senegal, and Togo.

Vol. 7, No. 1/2022 – 13 articles, 26 authors from Benin, France, Cameroon, Canada, Lebanon, Mali, Poland, Senegal, and Togo.

Vol. 7, No. 2/2022 – 11 articles, 18 authors from France, Cameroon, Canada, Congo-Brazzaville, Lebanon, Poland, Senegal, and Togo.

Vol. 8, No. 1/2023 – 12 articles

Vol. 8, No. 2/2023 – 8 articles

Vol. 9, No. 1/2024 – 12 articles

Vol. 9, No. 2/2024 – 12 articles

In total, 17 issues of RIELF have been published under the editorship of Professor Bernard Landais and Professor Krzysztof Malaga, featuring 224 articles authored by scholars from Algeria, Belgium, Benin, Bulgaria, Burkina Faso, Chile, Chad, the Democratic Republic of the Congo, France, Gabon, Guyana, Spain, Cameroon, Canada, Congo-Brazzaville, Cuba, Lebanon, Mali, Morocco, Niger, Peru, Poland, Portugal, Russia, Romania, Senegal, Serbia, the United States, Scotland, Togo, Tunisia, Ukraine, the United Kingdom, Italy, and Côte d’Ivoire.

All issues of RIELF are available on the journal’s website at: https://journals.ue.poznan.pl/rielf/issue/archive.

Staff members

Consultations in the current semester

Dr hab. Krzysztof Echaust, prof. UEP

Budynek B, room no 307

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

-

room 307; building B

Dr hab. Marcin Anholcer, prof. UEP

Centrum Edukacyjne Usług Elektronicznych, room no 4.5

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

-

room 4.5; building D

Dr hab. Helena Gaspars-Wieloch, prof. UEP

Centrum Edukacyjne Usług Elektronicznych, room no 4.6

Dr hab. Roman Kiedrowski

Centrum Edukacyjne Usług Elektronicznych, room no 4.4

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

-

room 4.4; building D

Dr hab. Michał Konopczyński, prof. UEP

Centrum Edukacyjne Usług Elektronicznych, room no 4.7

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

Dr Jacek Kowalewski

Budynek B, room no 303

Dr Agnieszka Lach

Budynek B, room no 303

-

room 303; building B

-

room 303; building B

-

room 303; building B

-

room 303; building B

-

room 303; building B

Prof. dr hab. Krzysztof Malaga

Centrum Edukacyjne Usług Elektronicznych, room no 4.3

Dr hab. Justyna Rój, prof. UEP

Centrum Edukacyjne Usług Elektronicznych, room no 4.6

Dr Karolina Sobczak-Marcinkowska

Centrum Edukacyjne Usług Elektronicznych, room no 4.2

Dr Izabela Śliwa

Centrum Edukacyjne Usług Elektronicznych, room no 4.7

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

-

room 4.7; building D

Dr Aleksandra Wójcicka-Wójtowicz

Budynek B, room no 303

Mgr Kacper Zielak

Building D, room no 4.2

Didactics

-

Lectures and classes conducted

Analiza danych w PASW Statistics

Analiza decyzyjna

Badania operacyjne

Badania operacyjne w logistyce

Biznes plan

Dynamic stochastic general equilibirum models

Dynamika systemów ekonomicznych

Ekonometria

Ekonomia matematyczna

Finanse

Finanse przedsiębiorstw

General equilibrium theory

Growth theory

Informatyka w zarządzaniu – laboratoria

Instrumenty pochodne

Inżynieria finansowa – projekt

Matematyka

Matematyka dyskretna

Mathematics

Macroeconomics

Macroeconomics of the european monetary union

Makroekonomia

Makroekonomia zaawansowana

Microeconomics

Mikroekonomia

Modele dynamiki ekonomicznej

Optymalizacja dyskretna

Optymalizacja przedsięwzięć

Podstawy ekonomii matematycznej

Probability theory and stochastic processes

Stability and chaos in dynamic economics

Teoria wzrostu gospodarczego

Teoriopoznawcze aspekty modelowania matematycznego w ekonomii

Wzrost gospodarczy w badaniach empirycznych

Zarządzanie instrumentami finansowymi obarczonymi ryzykiem wartości bieżącej

Zarządzanie projektami

Zarządzanie ryzykiem

Zastosowanie matematyki w ekonomii i zarządzaniu

-

bachelor seminars in polish

bachelor seminars in polish

-

master seminars in polish

master seminars in polish