Artykuł w International Review of Financial Analysis

Aleksander Mercik, Barbara Będowska-Sójka, Sitara Karim, Adam Zaremba,

Cross-sectional interactions in cryptocurrency returns, International Review of Financial Analysis, Volume 97, 2025, https://doi.org/10.1016/j.irfa.2024.103809.

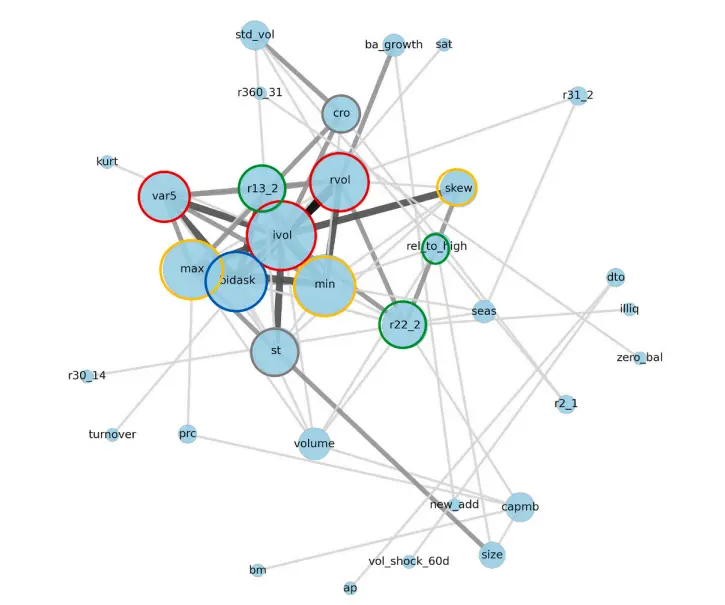

Abstract: We investigate interaction effects in cryptocurrency markets by constructing and evaluating double-sorted portfolios based on 40 different characteristics. Using a dataset of over 500 major coins and tokens from 2017 to 2023, we identify numerous significant interactions. The most pronounced effects arise from the interplay of liquidity, risk, and past return measures. An out-of-sample long-short strategy that selects the top and bottom interactions achieves a Sharpe ratio exceeding 1. However, network graph analysis and additional tests reveal that low liquidity, which raises transaction costs, can dampen trading activity and contribute to the persistence of these anomalies.